BPT

It will take some time to adjust and recover from the major disruption experienced because of the COVID-19 pandemic, and many consumers are figuring out how to cope with challenges when it comes to their financial health.

A lot of people are feeling the financial strain of not being able to go to work or operate their businesses normally, and many more have had to rethink personal plans and goals for the year.

However, there are proactive steps you can take to stay focused on your long-term financial health. Consider these suggestions moving forward.

Use tech to your advantage

It is always important for consumers to be aware of the digital banking resources available to them, but now with social distancing measures in place across the country it is more important than ever to know how to use your bank’s website or mobile app to manage your finances from home.

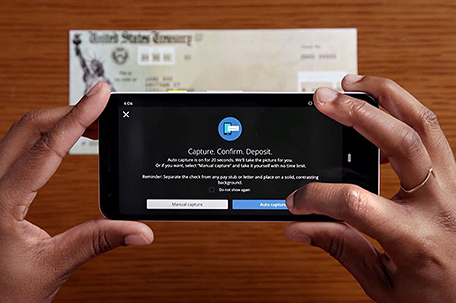

Generally speaking, financial technology can help you with managing your bills, set up direct deposits or make and receive payments from friends and family. Also, if you are still expecting a stimulus check, check your banking app for mobile deposit capabilities. Using QuickDeposit through Chase, as an example, you can skip the trip to the ATM by taking a photo of the front and back of the check on your mobile device. If you use the Chase Mobile app, an array of videos can help you make the most of these tools.

Stay alert to scams

Experts suggest triple-checking your social messages, emails or other solicitations for potential fraud. For example, a scammer trying to steal your stimulus check may claim the IRS needs personal information such as your name, password, PIN or account information. Legitimate financial institutions will never ask for such confidential information when reaching out to you. Be especially alert to messaging that mentions COVID-19 and/or includes either an urgent call to action or contains suspicious links. If you are in doubt, check out official resources like the Federal Trade Commission’s consumer website for information on common scams and how to report them. Also, be sure your financial institution has your latest contact information so they can reach out to you if they detect any suspected fraud on your account.

Check your due dates

Round up all your pending bills and make a list of when they’re due. You can then check the websites listed on bills for utilities, auto loans, mortgages or credit cards to find out if the companies are allowing delayed payments and/or waiving late fees during the COVID crisis – and whether opting in on those options could adversely affect your credit score. If you must delay payments, contact the payees to discuss your payment plan; they may be able to negotiate better terms.

Review what money is available to you

You’re bound to feel more financially secure if you’re aware of all sources of cash and credit you could draw upon to help you through difficult times.

Adjust and readjust

Keep evaluating and changing your budget to account for income reductions and changes in expenses. Recording all purchases can help you pinpoint exactly where your money is going. You may find you’re now spending significantly less on transportation, clothing and entertainment and can reallocate that money toward other essential needs. Don’t have a budget currently built? The free Budget Builder template from Chase can help you get started.

Keep current on credit

Understand which of your financial actions can impact your credit score; that can be particularly important if you’re applying for a loan or credit card or refinancing debt on your home loan. The free Chase Credit Journey tool can help you understand your overall credit health.

Rebuild when you can

If you’re using savings to help you right now, start to rebuild when you can, setting up a safety net to help you cover your everyday needs. If you are expecting or have received a lump sum or relief funds, think about setting some aside for savings if at all possible. Financial health is a journey, and Chase can help you deal with today’s challenges while establishing a solid plan for the future.

Visit Chase.com/stayconnected for more financial resources to help you bolster your financial health or address issues related to COVID-19.

Leave a Comment