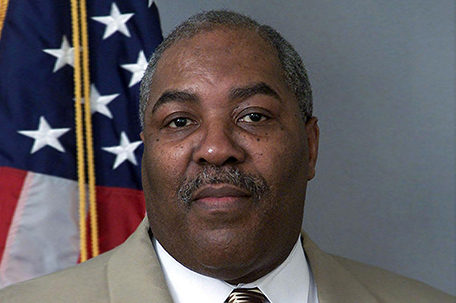

ABOVE PHOTO: Rep. W. Curtis Thomas

In an attempt to reinvigorate the Second Stage Loan Program, State Rep. W. Curtis Thomas, D-Phila., has introduced a bill this week that would increase small businesses’ access to capital by expanding the underutilized program.

Thomas’s bill, H.B. 2315, would allow both commercial lending institutions and economic development organizations to apply for loan guarantees to help securitize capital for small businesses. The bill would also change the name of the program to the Small Business Investment Guarantee Program.

Thomas, who serves as the Democratic chairman of the House Commerce Committee, said he was inspired to make changes to improve the program when he learned that a balance of $46.6 million still remained of the original $50 million allotment.

“This program was created and money was set aside to help businesses across the state grow,” Thomas said. “Currently, this money is lying dormant helping no one. My bill would change that.”

House Bill 2315 would prioritize loan applications related to life sciences, advanced technology, energy development, aviation and aerospace. Small businesses engaged in commercial, services, retail and agricultural production activities are eligible to apply for the program if they are located within an underserved area of a distressed community.

Loans through the program, which will continue to be administered through the Commonwealth Financing Agency, would not be approved unless the borrower secures an equity investment of at least ten percent of the total project cost from non-public sources. No loan guarantees would exceed $1 million.

“These loans will help small businesses grow and expand,” Thomas said. “Right now, many businesses are having trouble surviving. This program will help them do more than just scrape by. It will allow these businesses, and the surrounding communities, to thrive.”

The Second Stage Loan Program currently only serves commercial lending institutions working with life science, advanced technology or manufacturing businesses. House Bill 2315 is currently awaiting consideration by the House Commerce Committee.

Leave a Comment