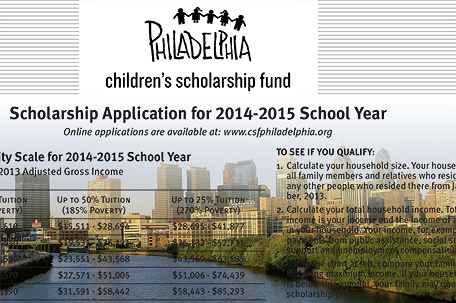

Philadelphia families are desperate for quality, safe education for their children. This has never been more apparent than today, with the efforts at improving our public and charter schools moving at a glacial pace. Thousands of Philadelphia children are left with little alternative, as the schools they are forced to attend are often within the lowest of performing schools in the state. Demand for alternatives, especially from low-income Philadelphia families who do not have the financial access to alternatives, is great. But, there is hope: Children’s Scholarship Fund Philadelphia (CSFP) will issue 2,000 new four-year scholarships for Philadelphia families who need financial assistance to send their children to a tuition-based, K-8th grade school of their choice. Families must act now, because completed applications must be received no later than March 1, 2014. Only the first 10,000 applications received will be entered into the random lottery.

Scholarship award selections will be made in mid-March (Lottery Day) when CSFP supporters call families chosen with the good news that their child or children will receive a partial scholarship to attend a tuition-based school of their choice. Applications are available online at www.csfphiladelphia.org, as well as at The Free Library of Philadelphia, YMCAs, the Police Athletic League, city recreation centers, and many other area community organizations.

This year, thanks to generous corporate donors, like ACE, CIGNA, Comcast, Glenville Capital Partners, Milestone Partners, PECO, PNC, Radian, SKF, Inc., Sparks Marketing, TD Bank, N.A., USLI and Wawa, CSFP will once again issue Opportunity Scholarship Tax Credit (OSTC) scholarships are available for eligible families whose designated public school is in the lowest performing 15 percent of public schools in Pennsylvania. These OSTC scholarships are made possible through an expanded state tax credit program that allows businesses that pay Pennsylvania corporate net income tax to impact the life of a child today. OSTC has almost $20 million in tax credits available right now, and allows businesses to reallocate their tax liability by donating to eligible scholarship organizations, like CSFP. CSFP calls on local business leaders to step up and spread the word in an effort to keep these tax credit dollars local and help alleviate the pressures on the district and provide more families a choice for a quality education for their children.

Leave a Comment